Alexandra is a junior associate editor of HomeLight.com. Previously, she served as a writer and social media manager at Santa Barbara Life & Style Magazine, in addition to interning at the nonprofit honors society Phi Beta Kappa. Alexandra holds a bachelor's degree in communication and global studies from UC Santa Barbara, and she has three years of experience reporting on topics including international travel, luxury properties, celebrity interviews, fine dining, and more.

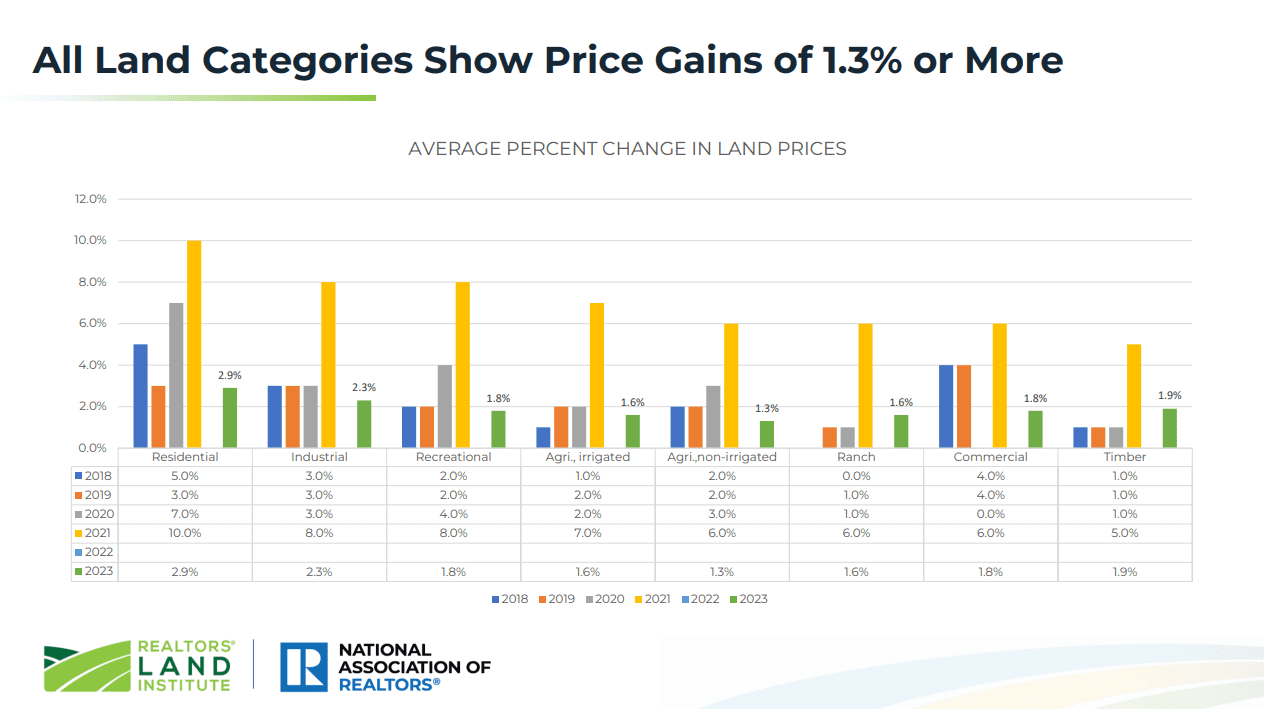

According to the National Association of Realtors Land Market Survey, land value nationwide rose to $18.6 trillion in 2023, up from $17.2 trillion the year prior. Land price growth rose to a rate of 1.9%, with residential, industrial, and timber land categories specifically producing the highest growth. But, your individual slice of land could be valued at a dramatically higher or lower price per acre depending on factors like its topography, road access, and zoning.

Step one: Talk to a few buyer's agents!

Tell us a little bit about your plans (where you’re looking to buy and when you want to make a purchase) and we’ll connect you with top-rated buyer’s agents in your area. It takes only a few minutes, and it’s free.

Enter land appraisals — a special type of valuation for undeveloped property essential to a smooth land exchange between two parties. This guide will take the mystery out of land appraisals for the average landowner and cover a lot of ground, including:

A plot of empty land offers more than meets the eye. Where you see just a stretch of soil and grass, an experienced land appraiser will see close proximity to a desirable community, or optimal soil quality for farming, or the ideal location for a future shopping mall — all of which influence the value of that piece of property.

A land appraisal can be more complex than appraising an existing house. A quick scan of a standard land appraisal form shows the multitude of factors the appraiser must evaluate and give weight to. Below are some of the main factors that impact a land valuation:

Although there aren’t nearly as many vacant land sales as there are sales of existing homes, a land appraiser will look for recently sold parcels of land similar in size and type to yours to use as a starting point.

Land comps are available through different online databases. For example, the Lands of America Comparable Sales Program has a trove of information on land property sales for sellers, buyers, and real estate professionals such as appraisers. After running comps, the appraiser will then make adjustments based on the characteristics of your specific property.

When valuing undeveloped land, an appraiser’s job is to determine what’s called the “highest and best use” of the property. The Appraisal Institute defines this as “the reasonably probable and legal use of vacant land or an improved property that is physically possible, appropriately supported, financially feasible, and that results in the highest value.”

In simpler terms: What is the most profitable way to use the land?

For example, when looking at a standard rectangular lot in a housing subdivision, the most profitable use would be to build a house in line with the other properties surrounding it. But for a large tract of land in a commercial area, building a shopping mall or movie theater could be the highest and best use. And when evaluating land in a rural area, cultivating it as farmland might yield the most profit.

Erik Pogwist — the chief appraiser of Incenter Appraisal Management, a national provider of best-of-breed valuations, inspections, and data products for lenders across the country — regularly performs land valuations. He explains:

“Value increases based on what you can use the land for. Therefore, an appraiser must be able to recognize the utility of the parcel to be able to properly value the site.”

To determine whether the owner’s use of land qualifies as “highest and best use,” appraisers run four different tests:

NAR’s Land Market Survey breaks down the average percent change in land prices by different land types and uses:

You might assume that if one acre of land is worth $50,000, then four acres would be $200,000, but that’s not the case. As the size of the land goes up, the value per acre actually goes down, a phenomenon known in the economic world as the “law of diminishing returns.” It’s essentially the land equivalent of buying in bulk at the store: A larger item typically costs less per unit than the same item in a smaller size.

The shape of the land also impacts its potential use and value, as an irregularly shaped lot may be less desirable. For example, if a vacant lot is pie-shaped with the wider part in the front, that means a home built on that land would have more yard space in the front than the back.

That shape could result in a lower value, as most homeowners would prefer to have more usable space in the backyard where there is more privacy. And an irregular or triangle-shaped lot can be difficult to build on, as it can limit what footprint the developer can use for the house.

One of the biggest drivers of a piece of land’s value is the amount of frontage — that is, how much of it is accessible by road. Particularly if you’re selling a larger tract of land that will be subdivided, each municipality may have specific zoning rules that dictate how much road frontage each lot must have, explains Melanie Hunt, a top Fort Worth, Texas, real estate agent who often sells vacant land.

“The more road frontage and the more acres the road touches, the higher the land value will be,” says Hunt. “For example, if there are 500 feet of road frontage and the land is very narrow and deep and hard to build on, the back acres won’t be worth nearly as much. But a large corner lot with lots of frontage will have much more value.”

A land appraiser will take into account the availability of water, sewer, and electrical hookups for the land. If these elements aren’t available, the buyer would need to bring them in. That project can cost anywhere from $10,000 up to $30,000 or more, depending on the scope and size of the land. Plus, it can take months to obtain all of the permits and complete all of the work.

A land developer may have the option to use a septic system or water wells, but these solutions also cost thousands of dollars. “Generally speaking, having power, water, and sewer access at the property line will drive the value of the land way up,” says Hunt.

The topography, or geographical makeup, of a piece of land can have a big impact on its value. For example, swampy land won’t be suitable for building a home, but a buyer might want it for recreational purposes. An appraiser will examine the land’s physical features — including the presence of mountains, steep grades, rivers, lakes, and valleys — as a means of determining its use potential.

Just as a built home comes with certain selling points, like a pool or location on a quiet street, a parcel of land can offer certain aesthetic or functional features that make it more valuable. For example, an appraiser could attribute value to lake access, a fishing pond, a spectacular view, hiking or walking trails, or other desirable elements, as long as they don’t impede on the land’s usability.

Most land has been zoned, which means it’s been classified for a certain type of use.

The current zoning requirements may limit how a buyer can use or develop a parcel of land, which has a direct impact on its value. Some of the most common types of land zoning include:

Beyond what type of building can be constructed, zoning laws can also control specific construction details, like the height of structures. The appraiser will consider the zoning when determining the valuation. If the laws are restrictive, they could potentially deter would-be buyers.

According to FEMA, more than 13 million homeowners live in the high-risk 100-year flood plain, which means they face a 1% chance of flooding during any given year. If your land is located in a floodplain, the appraiser will look into how often floods occur and which areas are most prone to flooding. High flood risk can sink the value of vacant land — by as much as 8%, according to some studies.

Hunt says that the buyer will usually order an environmental study prior to closing, as the results have to be disclosed at appraisal. Any hazardous substances or contaminants found in the soil — such as pesticides, radon, lead, or asbestos — can cause land value to plummet. Any wetlands, wildlife, or endangered species will also come into play, as they could impact the ability to develop the land.

Many landowners possess vacant lots that will someday become the site of a house or building. But, appraisers will treat rural tracts of land or farmland used for agricultural purposes differently than they do residential or commercial land.

“Rural appraisals can be more challenging due to the lack of sales data, which is naturally the result of having many fewer homes than suburban or urban markets,” explains Pogwist.

“In some rural counties, there may not be sales for many months or even years. The appraiser would need to expand his or her comparable sale search far beyond what is typical in order to find sales that could be utilized as value indicators for a property.”

The appraiser will consider some of the same factors — access, topography, configuration — but the size of rural land is often much larger, adding extra time and cost to the valuation process. The value will also hinge on things like the farm economy, the quality of the soil, irrigation and drainage, the local climate and rainfall, and any current farming regulations that might limit usage of the land.

The portion of usable space is one of the key factors in farmland appraisals. As Hunt explains: “If you have 100 acres of land, and 50 of it is usable and the other 50 is comprised of gullies and trees that can’t be plowed or cultivated or grazed, the value of the usable acres will be much higher than the rest.”

Pogwist often sees buyers offer more for vacant land than the appraisal amount, particularly in cases where they see income potential that the appraiser might not recognize, or if there are multiple buyers bidding for the land. “An appraisal is nothing more than an expert’s opinion, based on experience, sound data, and thoughtful analysis,” he says. “Someone may have the need, desire, and resources to pay more, and the seller would likely be quite happy to sell for more.”

In Hunt’s experience, approximately 25% of buyers go over the appraised value, particularly if it’s a unique property or if its purpose drives it above the normal land value. In that case, if the buyer is getting any type of loan to finance the land purchase, the buyer would need to bring the additional funds to closing to make up the difference in price.