Trustnet looks into Aviva’s pension funds with the best returns over 10 years.

People don’t sometimes think of themselves as investors, but most now have a pension fund paid into every month by their employer through a workplace pension scheme.

While some take an active interest in their pensions, others that do not look at it would be wise to check where their provider is investing their money and whether other funds are more suitable and delivering better performance.

Below, we look into Aviva’s best-performing mixed-asset funds of the past 10 years, choosing the most relevant units (versions) of each fund, where more than one was available.

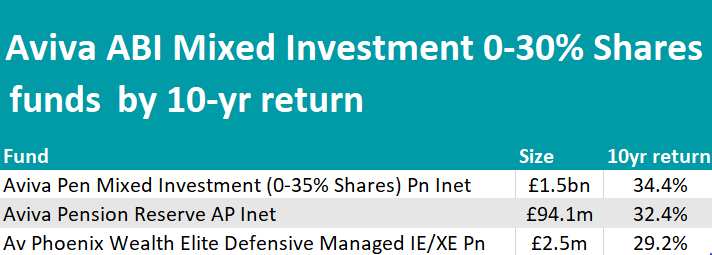

We start with the ABI Mixed Investment 0-35% Shares sector, where the average return of 14.1% over the past decade was outdone by all three Aviva funds with a 10-year track record within this peer group.

The best performer of the three was Aviva Pension Mixed Investment (0-35% Shares), which with £1.5bn of assets under management (AUM) is also the largest. It is co-managed by Kevin O' Nolan and Guillaume Paillat from Aviva’s long-only multi-asset team, who mainly invests in global fixed income, which makes up 41.7% of the portfolio.

Source: FE Analytics

Gavin Counsell achieved a similar return with the Aviva Pension Reserve strategy, where he focuses on UK corporate bonds (51.1%) and international equities (23.3%).

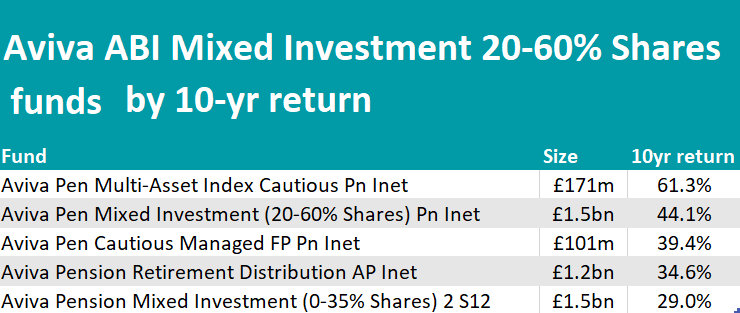

Moving up the risk scale, the ABI Mixed Investment 20-60% Shares sector has made 23.5% over 10 years, again outperformed by all the Aviva funds below.

The best of the list was Aviva Pen Multi-Asset Index Cautious, a portfolio built of passive strategies and index trackers with a 47.8% exposure to international equities and 31.1% to international bonds. Its top-10 holdings include Apple, Microsoft, Nvidia, Amazon, Alphabet and Tesla and returned close to three times the average peer.

Source: FE Analytics

With a similar global equities allocation (50.5%) but preferring UK corporate fixed interest to global, the actively managed (and much bigger, with an AUM of £1.2bn) Aviva Pension Retirement Distribution fund made 34.6% over the past 10 years.

Aviva Pen Mixed Investment (20-60% Shares) came in as second-best, making almost double the return of its sector peers through a lower percentage of credit than its lower-risk twin fund (30%) and then adding 24.3% of global equities, 13.4% of UK equities and 10.9% in cash.

Another version of the Aviva Pension Mixed Investment (0-35% Shares) fund also appears in the list, with a large chunk of the portfolio invested in shares.

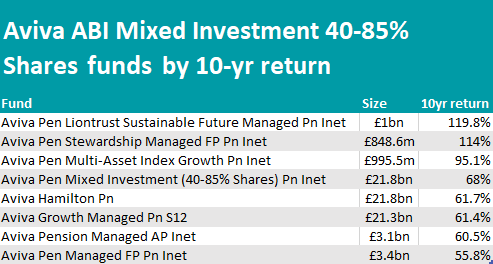

The ABI Mixed Investment 40-85% Shares sector contains some of the largest funds managed by Aviva. Over 10 years the average sector return of 47.4% has been beaten by all the main Aviva strategies, as highlighted in the table below.

The best return was achieved by a third-party fund, however – the Aviva Pen Liontrust Sustainable Future Managed portfolio, which made 119.8%.

Managed by Liontrust’s Peter Michaelis and Simon Clements, the fund invests in North American (38.3%), UK (20.3%) and European equities (12.5%), with a main fixed-income exposure allocated to UK corporate bonds (12%).

Source: FE Analytics

Not far below is Aviva Pen Stewardship Managed, which is led by Schroder’s Johanna Kyrklund and seeks both growth and income through ethical investments.

Here too, the tracker fund Aviva Pen Multi-Asset Index Growth held its own and with a return of 95.1%, gaining third position in the ranking.

With £21.8bn of AUM, Aviva Pen Mixed Investment (40-85% Shares) is one of the most popular funds in Aviva’s range and made 95.1% since 2013.

This article is part of an ongoing series on best-performing pension funds by provider. In the previous instalment, we looked at Scottish Widows funds.